How To Enable a Default Tax Rate on POS

Use Case Scenario

Use Case ScenarioBeanHaven Café, a local coffee shop, recently expanded their menu to include new breakfast sandwiches and pastries. As their staff adds new products directly through the POS system, the manager noticed that taxes weren’t always applied consistently—especially during busy hours when employees forgot to manually select a tax rate.

With the Default Tax on POS feature enabled, BeanHaven Café’s manager configured a Standard Sales Tax (7%) as the default within the POS. Now, whenever new items are added—whether it’s a seasonal latte or a breakfast croissant—the correct tax is automatically applied without any extra steps.

This not only ensures consistent tax accuracy across all new products, but also keeps the POS and Merchant Portal perfectly synced. Any updates made to the default tax online instantly reflect in-store, saving staff time and reducing the chance of errors during rush hours.

Ultimately, BeanHaven Café enjoys smoother operations, fewer manual adjustments, and full confidence that every sale includes the right tax—automatically.

How to Enable Default Taxes via POS?

Step 1

Sign into the Applova POS with the credentials of your business.

Step 2

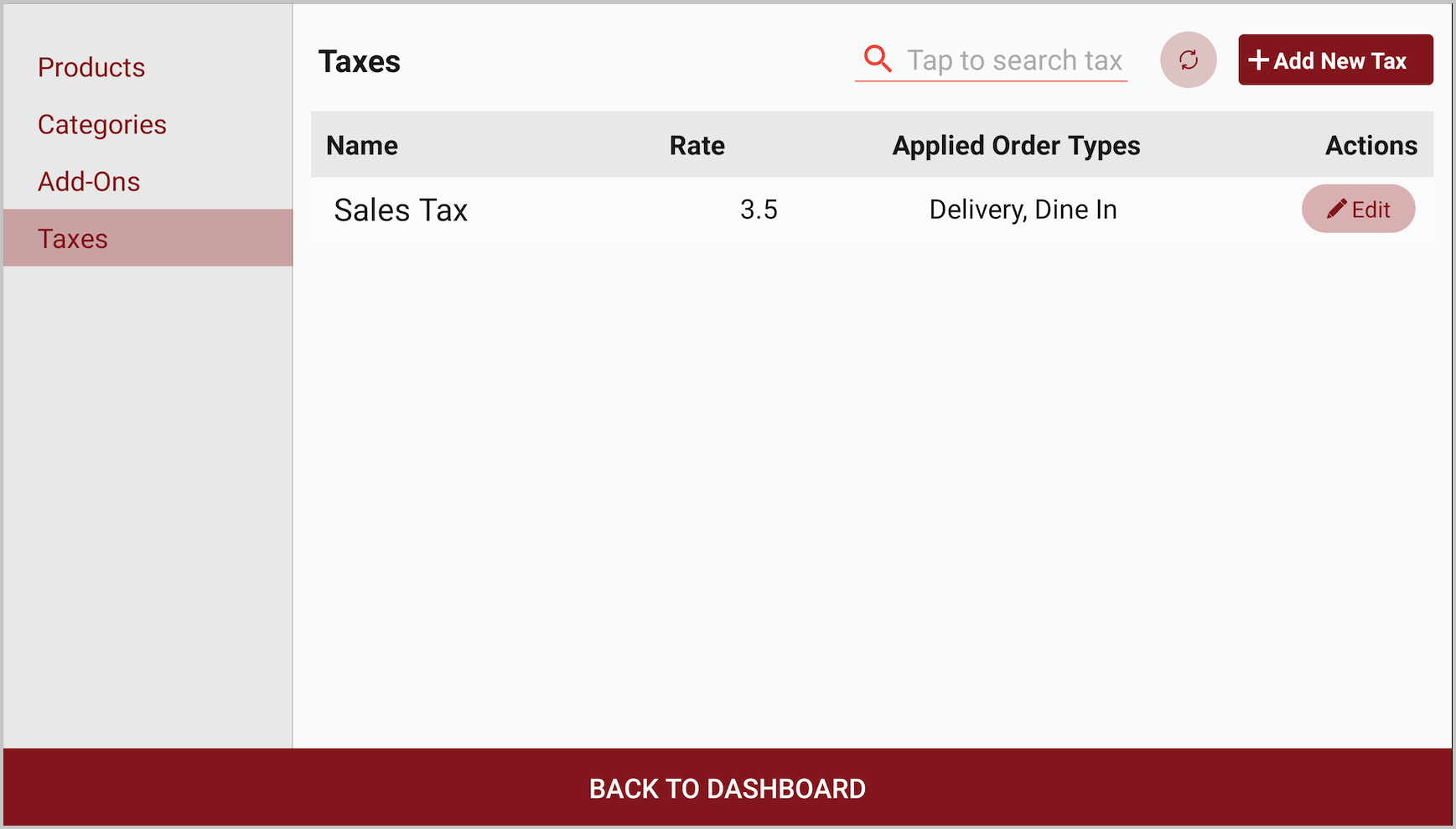

Navigate to "Manage Products-> Taxes" tab

Image Link

Step 3

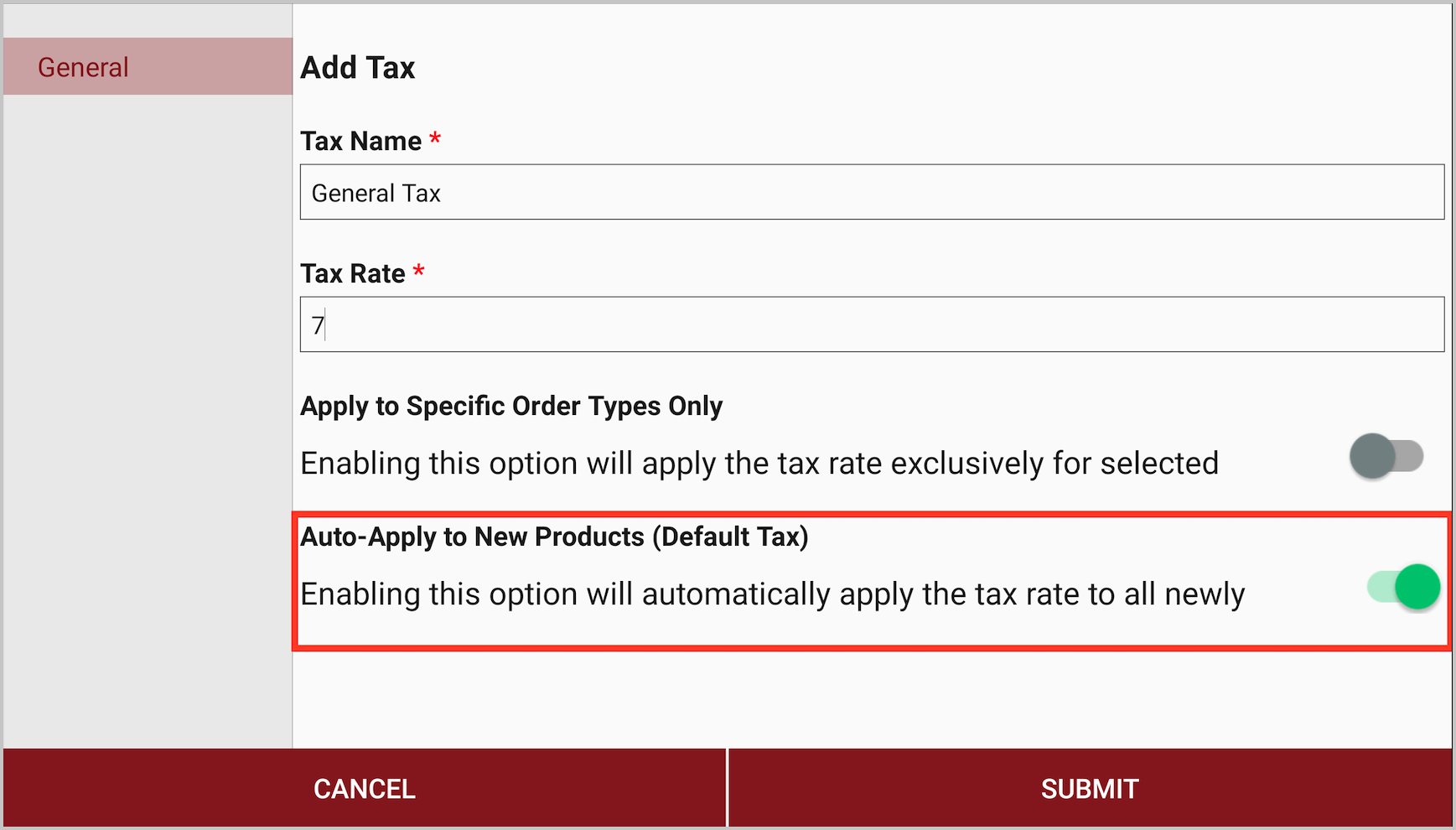

Click on "Add New Tax"

Image Link

Step 4

Fill in the tax details and swtich the "Auto-Apply to New Products" toggle to the "ON" state.

Image Link

Name: Enter the tax name.

Rate: Specify the tax percentage.

Apply by Specific Order Types: Toggle ON if this tax applies only to selected order types (e.g., Delivery, Dine-In, Takeaway).

Apply Automatically for New Products (Default Tax): Toggle ON to make this tax the default.

Enabling the “Apply Automatically for New Products (Default Tax)” option will ensure this tax rate is automatically assigned whenever a new product is created on POS.

Enabling the “Apply Automatically for New Products (Default Tax)” option will ensure this tax rate is automatically assigned whenever a new product is created on POS.Step 5

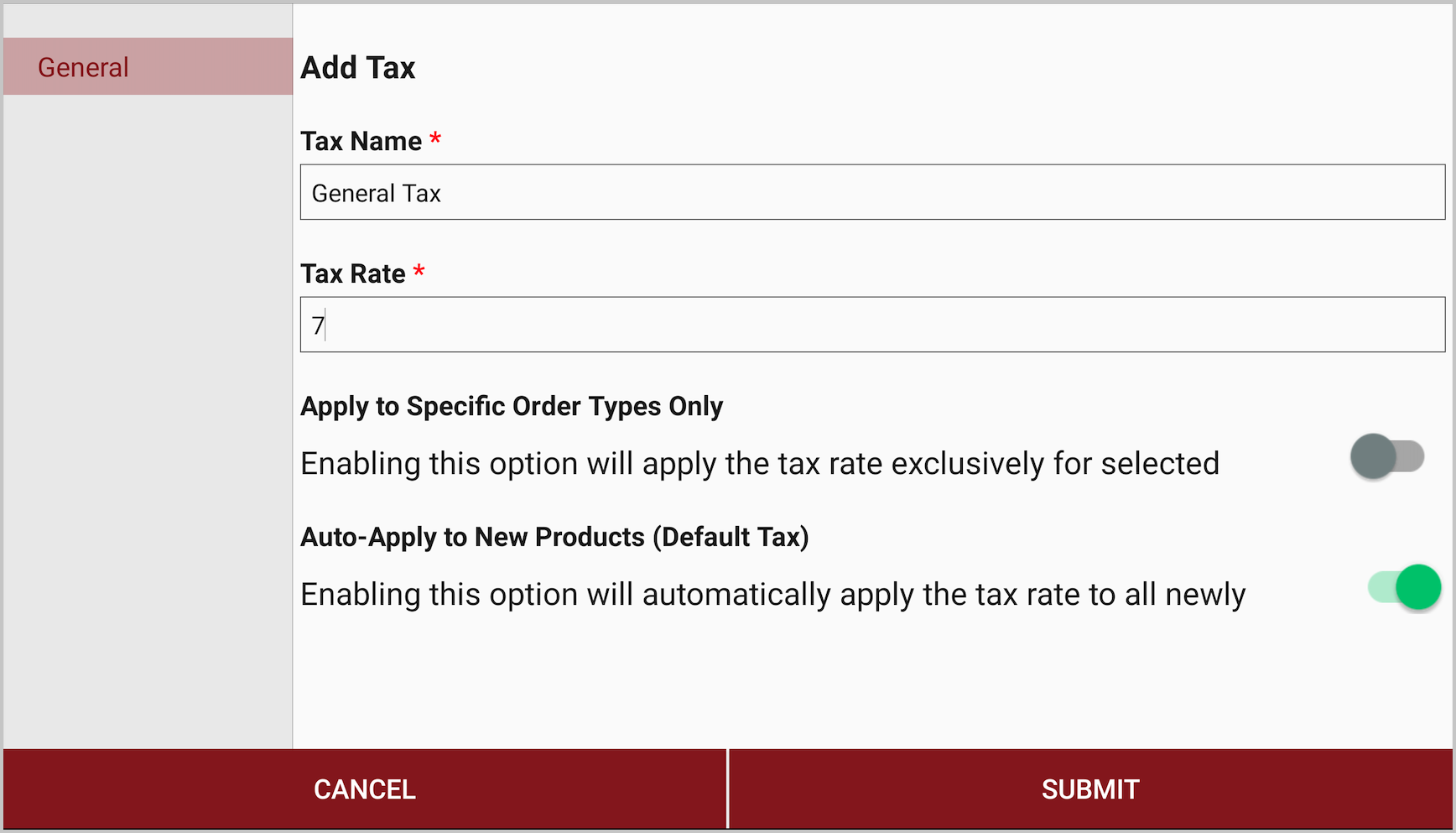

Click "Submit" to save your configuration.

Image Link

Related Articles

How to Manage Taxes on Applova POS?

This can be performed only by the Store Manager. Supported Domains: Standalone Supported From: Applova POS (1.55.0.RELEASE) Please request the Applova Support team to enable the Manage Products feature for your business. Step 1 Sign into the Applova ...Accumulating Rewards on Applova POS

Supported Domains : Standalone Supported From : Applova POS (1.55.0.RELEASE) Please request the Applova Support team to enable accumulating rewards feature for your business. This allows the customers to be enrolled and start earning Applova rewards ...Quick Actions on Applova POS

The Quick Actions panel is a customizable set of buttons that gives staff faster access to frequently used functions during the order-taking process. It replaces the previous More Options menu, making key actions more accessible with fewer taps. This ...Cash Management on Applova POS

Supported On: Standalone Businesses Supported From: Applova POS (1.75.0.RELEASE) What is Cash Management? Cash management involves tracking and managing cash transactions in a business which includes handling cash sales, managing the initial cash ...AI Based Smart Product Recommendations on Applova POS

AI-driven product recommendations displays recommendations based on the customer's past purchases and the business's fast-moving products, when a customer is added to the order. This is a default feature available only for registered customers. Step ...